AI Summary

Key Highlights of Dashboard Applications for FinTech

This post explores the essential features and benefits of dashboard applications tailored for FinTech companies. The key insight: effective dashboards integrate security, customization, scalability, AI, and cross-platform access to empower businesses. It serves FinTech professionals seeking competitive, efficient tools to manage financial data, customer engagement, and compliance. The article details design considerations, technical capabilities like biometric security and data visualization, and user-focused innovations such as gamification and millennial targeting. By adopting these dashboards, FinTech firms can enhance decision-making, boost customer trust, and streamline operations, positioning themselves for growth in the rapidly evolving financial technology landscape.

Click below to hear a quick audio of what the author says about the blog.

Fintech dashboard is the cream of the crop when it comes to tools that help businesses stay in the lead of the ever-changing fintech landscape. They are the key to financial institutions and businesses staying competitive and compliant while also pinching pennies and boosting efficiency.

The adoption of digital technologies is transforming numerous industries, with financial services being one of them. Fintech refers to the use of technology to improve and automate financial services. It encompasses a wide range of applications and technologies. Types of fintech include mobile banking, online lending, digital payments, robo-advisors, insurtech, and cryptocurrency.

Did you know?

According to some experts, the fintech market is expected to reach a value of over $37 billion by the year 2026.

The FinTech sector is experiencing rapid growth, offering tailored services to small and medium-sized businesses (SMBs). As FinTech companies continue to expand their range of services, they rely on top-notch ERP software to manage their businesses. With fintech, you can simply use your smartphone to send money instantly through a mobile.

The specific features of a fintech dashboard can vary widely, depending on the specific services it offers and the target audience it is designed for. To create an excellent dashboard, we must follow a process that involves discovery, design, and execution, and regularly engage stakeholders to identify critical areas of interest.

When Creating a Great Dashboard, The Following Factors Should Be Taken into Consideration

- Knowing your target audience

- Utilizing appropriate data to tell a compelling story

- Selecting appropriate visuals

- Designing efficient user interactions

- Investing in the suitable technologies

Features of Dashboard Applications for FinTech Companies

Fintech dashboards provide financial data analytics and visualization for businesses. Some common technical features of dashboard applications for fintech companies include

Security and privacy control

Dashboard applications for fintech companies should have robust security and privacy controls to protect user data and transactions.

Customization and personalization

Users may be able to customize their dashboards to suit their specific business needs, such as by setting up alerts for certain transactions or monitoring particular financial instruments.

Scalability

The dashboard application should be able to handle large amounts of data and handle an increasing volume of data over time.

Data integration & Data Visualization

Dashboard applications for fintech companies may allow users to integrate data from various sources, such as financial transactions, market trends, customer data, and operational metrics.

Dashboard applications may provide users with various data visualization tools, such as charts, graphs, and maps, to help them understand and analyze financial data more effectively.

Gamification

Fintech companies are incorporating gamification by offering rewards or incentives for completing financial tasks, such as setting up a budget or investing a certain amount of money. These rewards can range from virtual badges and trophies to real-world prizes or discounts. By making financial tasks feel more like a game, fintech companies can make them more appealing and accessible to users.

Simplified UI

One of your main goals should be to make accessing fintech services as simple as possible for your users. This can involve creating an intuitive user experience, providing educational resources, and streamlining the process of using foreign exchanges, investments, PoS systems, and other complex financial tools. By helping your users navigate the world of fintech and providing a seamless experience, you can increase retention in the long run.

Biometric Security (Secure authentication)

Biometric security in fintech is the use of fingerprint or facial recognition to log into a dashboard or make a transaction. These features can provide an additional layer of security, as they are difficult to replicate or spoof. Other biometric security measures that may be used in fintech include voice recognition, iris scanning, heartbeat sensor, and palm vein scanning. By integrating sensors into an app, users can utilize their wearable device to easily and quickly login without the need to remember passwords or use other authentication methods.

Cross-Platform Capabilities

Cross-platform capabilities allow fintech dashboard apps to work on multiple operating systems or devices. This increases convenience for users, as they can access their accounts and perform transactions from any device, and can also be beneficial for businesses by attracting a wider audience and improving the user experience. Having cross-platform capabilities can improve accessibility and convenience for users, and can also lead to increased revenue for businesses.

Millennial-specific Content

Did you know that only 2 out of 5 millennials actively invest? This makes targeting millennials a key strategy for fintech apps. Even though they are a heavily online generation, their involvement in the fintech industry is limited. By creating a comprehensive and appealing app, with a user-friendly interface and effective marketing approach, fintech companies can build trust and establish themselves as a trusted source of financial advice and services for the millennial generation.

Use of Artificial Intelligence

The use of AI in fintech apps can improve the user experience, protect users from fraud and financial loss, and help organizations to better serve their customers. It can also help to automate tasks and make financial decisions on behalf of the user, freeing up their time and resources for other activities.

Voice Assistance

Voice assistance is one of the quickly adopted features in the tech space. It offers better convenience to people who have a smart virtual assistant installed in their homes.

Ease of API-Integration

APIs in fintech enables the exchange of data between parties involved in financial transactions, such as banks, third-party providers, websites, and consumers. It also reduces development costs.

Customer support

Dashboard applications for fintech companies should provide users with access to customer support, such as through email, phone, or live chat, to help them with any questions or issues they may have.

Accessibility

The dashboard application should be accessible from a variety of devices, including desktop computers, laptops, tablets, and smartphones.

User-friendly interface

The dashboard application should have a user-friendly interface that is easy to navigate and understand.

Did you know?

The 2020s will be remembered as the decade that reshapes worldwide finance. The fintech market is currently over $700 billion and growing.

Few Fintech Application Types and Examples

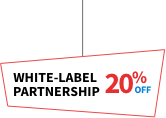

Personal Finance Management App

Personal finance management fintech type apps offer a convenient way for individuals to track their income, expenses, budgeting, and net worth, set and track financial goals, pay bills, and monitor their credit scores. These apps can consolidate financial information from multiple accounts into a single dashboard, making it easier to see where money is being spent and identify areas for cost-cutting or saving. They also often offer investment and asset tracking, access to financial advisors, and other resources to help users make the most of their money.

A personal finance management fintech app is a useful tool for anyone looking to better manage their finances and make informed financial decisions. This could be a goal to pay off debt, save for a down payment on a house, or save for retirement and provide you with notifications to help you stay on track.

Mint: Budget & Track Bills

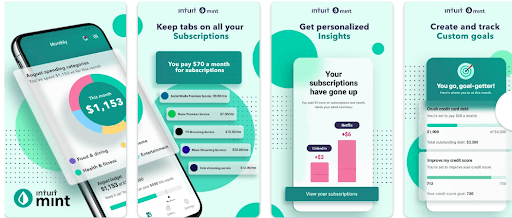

Investment Tracking and Trading App

An investment tracking and trading fintech app is a convenient and cost-effective way to manage your investment portfolio and execute trades. With a smartphone or tablet, users can track their portfolio, execute trades, and manage their investments from anywhere, at any time. Additionally, many fintech apps offer features such as real-time market data, personalized investment recommendations, and alerts for important events or changes in the market.

However, it is important to carefully research and compare different fintech apps to ensure that they are reputable and meet your investment needs, and to remember that investing carries risks, including the potential for losses and market volatility.

Acorns: Save & Invest

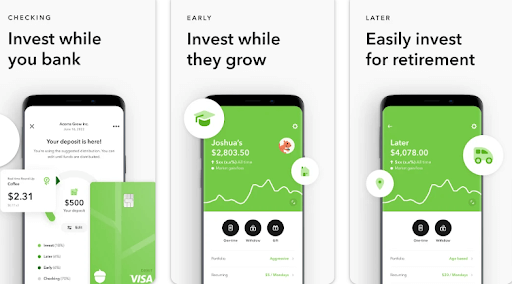

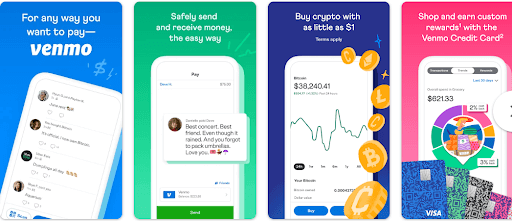

Payment App

Fintech payment application types are digital platforms that allow users to make financial transactions, such as sending and receiving payments, directly from their smartphones or other mobile devices, including peer-to-peer (P2P) payments, online shopping, and bill payments. They utilize innovative technology, such as blockchain and artificial intelligence, to provide a convenient and secure way for people to manage their money.

Some popular examples of fintech payment apps include PayPal, Venmo, and Cash App. These apps offer fast transaction speeds, low or no fees, and additional features like expense tracking and budgeting.

PayPal

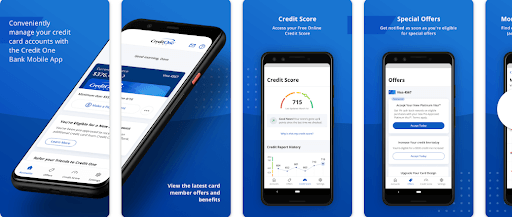

Digital Banking

Digital banking is a type of fintech that allows customers to access their bank accounts and perform financial transactions through a digital platform, such as a website or a mobile app. These fintech type apps offer real-time account updates, money transfer, and bill payment capabilities, mobile check deposit, investment and budgeting tools, credit card management, and advanced security measures to protect users’ financial information.

One of the main advantages of digital banking is convenience. Customers can access their accounts and perform financial transactions from any location with an internet connection.

Credit One Bank Mobile

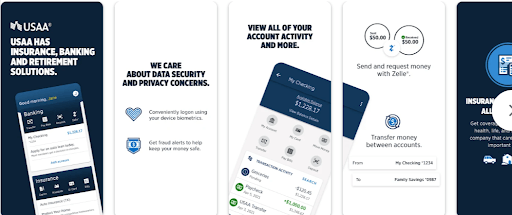

Insurance App

Gone are the days of trudging through a crowded insurance agency or being stuck on hold with a customer service representative. Fintech insurance apps have changed the way of purchase and manage insurance policies.

These digital platforms use financial technology to revolutionize the insurance industry, offering a convenient and easy way to compare quotes, purchase policies, and make claims. They also utilize advanced technology, such as artificial intelligence, to analyze our data and provide personalized insurance recommendations.

USAA Mobile

Digital Wallet

A digital wallet, also known as a fintech wallet, is a virtual wallet that allows users to store, manage, and use their financial and non-financial information and assets in a digital format. Digital wallets can be used for various purposes, such as making online and in-store payments, storing loyalty cards, and managing digital currencies.

They are often linked to a user’s bank account, credit card, or debit card and can be accessed through a smartphone app or web-based platform. Digital wallets offer a convenient and secure way for users to manage their financial transactions and assets, as they typically use advanced security measures such as encryption and multifactor authentication to protect user information and prevent fraud.

Venmo

RegTech App

Fintech RegTech apps are software applications that use financial technology and regulatory technology to help businesses comply with various regulations and laws. They can use advanced technologies such as AI and machine learning to automate compliance processes and reduce the risk of non-compliance and can be used in industries such as banking, insurance, and investment.

Fintech RegTech apps can help businesses stay up-to-date with changing regulations, reduce compliance costs, and improve efficiency.

Also Read

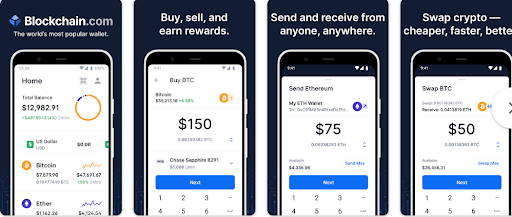

Cryptocurrency

Fintech cryptocurrency apps allow users to buy, sell, and manage their digital assets using financial technology. These apps offer a range of features such as real-time tracking, buy and sell using traditional currencies or other cryptocurrencies, and secure storage and management using a digital wallet.

Blockchain.com: Crypto Wallet

Lending and Borrowing App

Fintech lending and borrowing apps are digital platforms that allow individuals and small businesses to borrow and lend money using their smartphones or other digital devices. These apps often have more flexible terms and lower fees compared to traditional banks and financial institutions and offer user-friendly interfaces and additional features such as budgeting tools and financial education resources.

There are several types of fintech lending and borrowing apps, including peer-to-peer (P2P) lending platforms and online lending platforms, which connect borrowers with traditional financial institutions or investors. This can be a good option for borrowers who may not qualify for a traditional loan or who want to avoid paying high-interest rates and fees.

Personal Loan USA: Online Loan

Looking for Web App Development Services / Solutions?

Seize and experience the transformative impact of Web App Development Services & Solutions with ColorWhistle.

Conclusion

Dashboards are an important feature for fintech applications as they provide users with a clear and concise overview of their financial data and information. A dashboard allows users to see their accounts, transactions, and other financial data in a single, easy-to-read, rather than having to navigate through multiple screens or pages to find the information they need. This can be especially useful for users who want to track their spending, monitor their investments, or make informed financial decisions.

If you’re looking for a reliable partner to help you build a custom fintech dashboard or website development that fits your business’s needs, be sure to visit our website at ColorWhistle. We have a team of experienced developers who are ready to help you take your financial operations to the next level. So whether you’re a small business owner or a large corporation, don’t hesitate to call us at +1 (210) 787 3600 or send us a message. We’re ready to roll up our sleeves and get to work with you.

In quest of the Perfect Web App Development Buddy?

Be unrestricted to click the other trendy writes under this title that suits your needs the best!

What’s Next?

Now that you’ve had the chance to explore our blog, it’s time to take the next step and see what opportunities await!